2025 Broadmoor Police District Boundary and Revenue Review

Did You Know ?

You can now view the Broadmoor Police Department website in your preferred language! Simply click the drop-down box below to select your language, and the entire site will automatically translate so you can explore all our information and services with ease.

Watch Our Historical Video

Overview

The Broadmoor Police Protection District contracted NBS (A public finance consulting firm) and HdL (A property tax analytics/audits firm). Both firms ensure all areas receiving police services are properly included within the District’s official tax boundaries and that revenues are collected fairly and accurately.

Who is NBS and HdL

NBS is engaged by the Broadmoor Police Protection District to provide financial, administrative, and tax‐related consulting services.

HdL (HdL Companies) is a firm that provides revenue, tax, and license administration services, compliance and auditing solutions, and operational support to public and local government agencies.

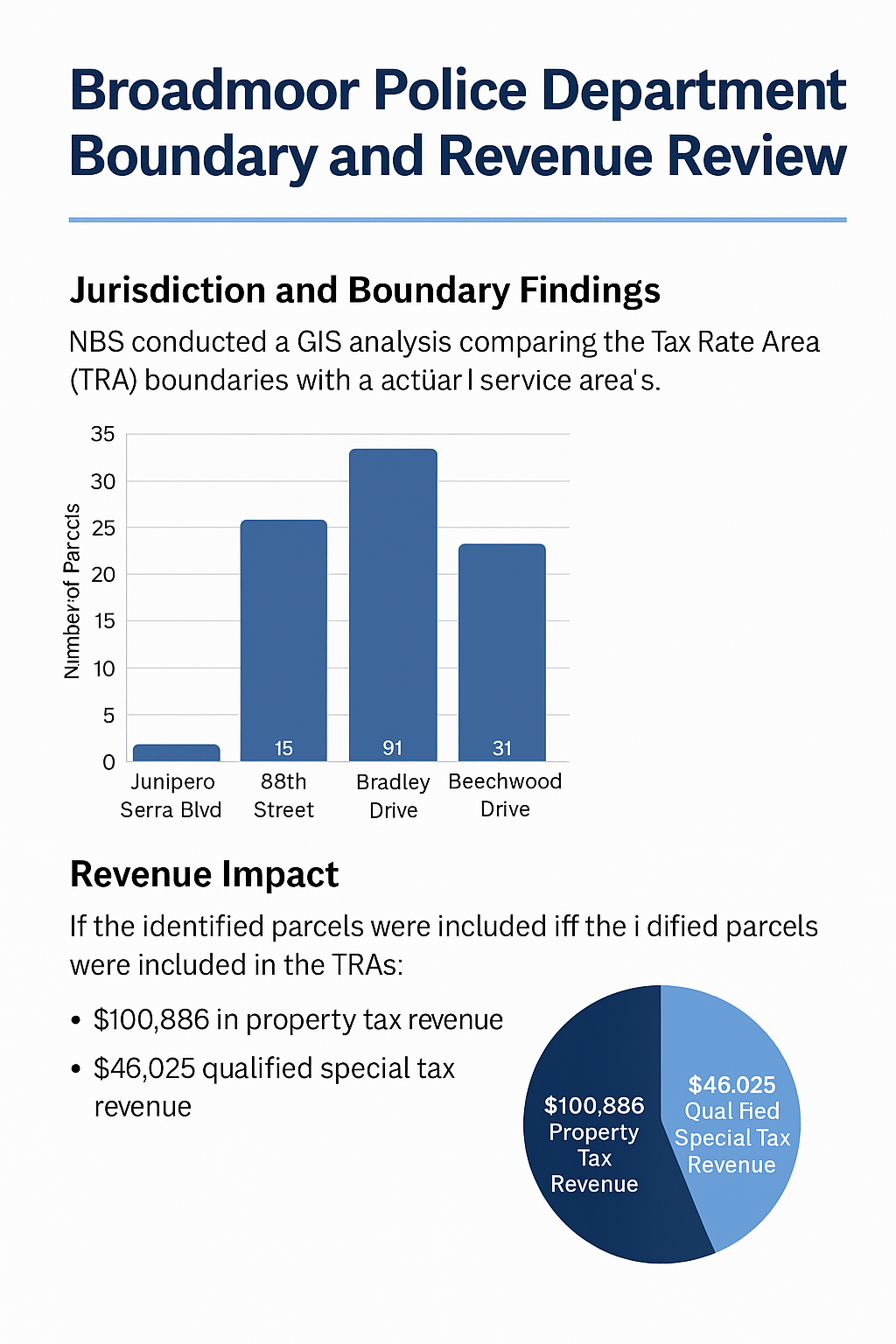

Jurisdiction and Boundary Findings

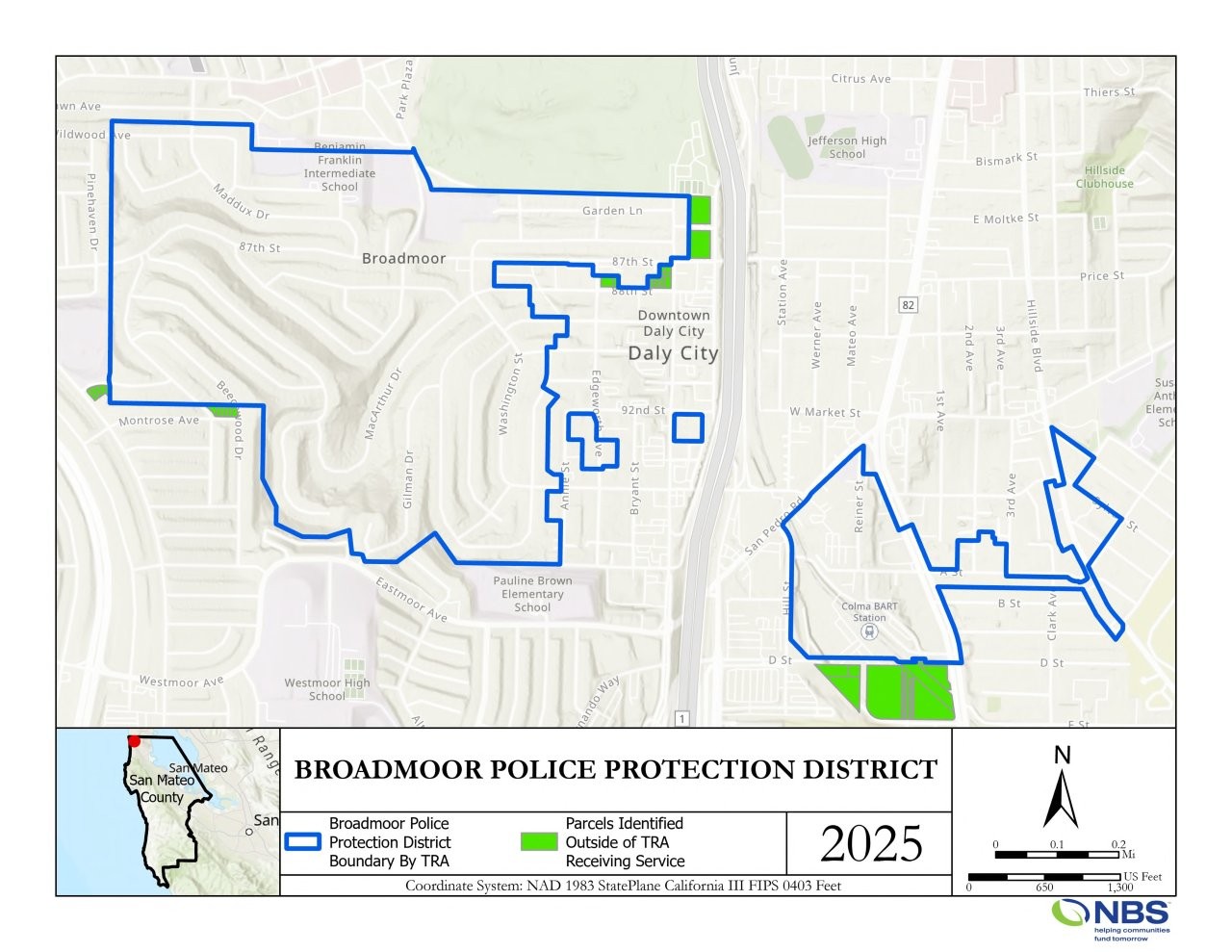

Using GIS mapping and historical service call data, NBS compared the District’s official boundary lines with the actual area served by Broadmoor Police.

The analysis found that **76 parcels** currently receive police services but are **not included in the County’s official Broadmoor Tax Rate Areas (TRAs)**.

These properties are primarily located along **Junipero Serra Boulevard, 88th Street, Bradley Drive, and Beechwood Drive** and **F Street. Although Broadmoor officers respond to incidents in these areas, they do not currently contribute to the District’s property tax revenue.

Revenue Impact

Based on the materials reviewed, HdL’s engagement with the Broadmoor Police Protection District (“District”) encompasses specialized revenue administration and compliance services designed to optimize the District’s tax base within its defined geographic boundaries and associated Tax Rate Areas (“TRAs”). HdL’s work involves the analysis and reconciliation of parcel data within those TRAs to ensure that all properties located within the District’s jurisdiction are properly classified and assessed in accordance with applicable laws governing special districts. By auditing assessment rolls, identifying non-compliant or misclassified parcels, and coordinating with County Assessor and Auditor-Controller offices, HdL seeks to correct errors that have historically resulted in revenue leakage. These corrective measures have a direct and material impact on the District’s fiscal position by ensuring that all taxable parcels within the special district’s geographic boundaries contribute equitably to the funding of police services. The cumulative effect of HdL’s efforts strengthens the District’s long-term revenue stability and compliance posture, thereby supporting sustainable public safety operations and the lawful administration of special tax assessments.

Reports Summary

October 2025 – Boundary & TRA Revenue Analysis

* Compared Broadmoor’s jurisdictional service area with assigned Tax Rate Areas (TRAs).

* Found **76 parcels** receiving police services but not contributing through taxes or assessments.

* Calculated both ad valorem and special tax losses from unassigned parcels.

* **Projected $146,911.56 in recoverable annual revenue** through TRA corrections and annexation.

July 2025 – Compliance Review and Audit Update

* Reviewed post-audit compliance and newly identified parcels missed in prior analyses.

* Focused on refining commercial and multi-family parcel data within county records.

* Recommended ongoing administrative monitoring to maintain accuracy in future levies.

* **Recovered an additional $27,963.12 in annual revenue** from newly corrected and included parcels.

March 2025 – In-Person Parcel Audit (Field Verification)

* Conducted on-site verification of 81 parcels to confirm classification accuracy.

* Detected additional errors in mixed-use, multi-family, and non-residential categories.

* Reclassified parcels and adjusted unit counts to ensure compliance with adopted rate structure.

* **Added $51,497.89 in new annual special tax revenue** following verification.

November 2024 – Parcel Audit (Initial Review)

* Comprehensive audit of all 1,533 taxable parcels to verify correct land use classifications and rate applications.

* Found widespread misclassifications across multi-family, residential care, and non-residential parcels.

* Corrected levy applications to align with the Authorizing Resolution and per-unit/bed requirements.

* **Identified $284,360.70 in additional annual revenue** once corrections and the 5% inflator were applied.

Total Combined Revenue Impact:

$284,360.70 + $51,497.89 + $27,963.12 + $146,911.56 = $510,733.27

Why This Matters

Ensuring that all properties receiving Broadmoor Police services are included within the District’s official boundaries is critical for:

Transparency: For good Public Governance.

Fairness: Every property that benefits from police protection should contribute its share of revenue.

Financial Sustainability: Additional revenue supports staffing, training, and equipment for public safety operations.

Accountability: Accurate boundaries and levies ensure compliance with State Board of Equalization (BOE) and LAFCO standards.

Long-Term Planning: Proper alignment of boundaries strengthens the District’s ability to plan, budget, and maintain high-quality service levels.

NBS Corrected Mapping

Next Steps

The District is working with all parties to ensure all properties receiving police services are properly recognized within the official Broadmoor Police Protection District boundaries. This process will help protect the District’s financial health and ensure that resources are distributed equitably throughout the community.

NBS Audit Reports

It is important to review these findings to ensure that every property benefiting from Broadmoor Police services is contributing its fair share to public safety funding — click the links below to explore each section of the report in detail.

NOTE: Data sources for Oct 2025 report include San Mateo County Assessors Office Property Information, State of California, BOE (Board of Equalization), TRA (Tax Rate Area Boundaries) and the BOE Broadmoor Annexation Files.

HdL Revenue Review

This report presents the results of a property tax audit for the Broadmoor Police District, verifying proper parcel allocations, identifying one misallocated unsecured asset, and confirming that assessed and enrolled values and revenue distributions align with county records.